3 Reasons to Get an Integrated Shield Plan… On Top of MediShield Life

Submitted by Advertiser KiasuParent

Sometime in June 2015, a KiasuParents member with the nickname Home Mummy posted this comment in the forum: “My child is diagnosed as having lazy eyes and the insurance company is excluding coverage for the eyes totally. So if my child got into an accident and has an eye injury, the insurance company would not pay. This doesn’t seem fair to me… I already tried to appeal but was unsuccessful.”

Parents like Home Mummy today wouldn’t have to worry about not getting any insurance coverage for their children with pre-existing conditions because they are covered under the MediShield Life scheme, which took effect on 1 November 2015.

If you are still not familiar with what MediShield Life offers, here are its benefits in a nutshell:

- Compulsory coverage for all Singapore Citizens and Permanent Residents, including the elderly and those with pre-existing conditions (Note: The old MediShield used to be a voluntary scheme).

- Lifetime protection, starting from birth

- Better protection and higher hospitalisation bills payouts

- Government subsidies for Pioneer Generation, lower-income families, etc to keep premiums affordable

But the extent of coverage offered by this national health insurance may not satisfy your needs. This is when an Integrated Shield Plan (IP) can be considered to complement MediShield Life.

Another KiasuParents forum user cyberbatt will probably concur, especially after his family’s experience with an unexpected medical bill. He shared that some years ago, his dad required an operation urgently due to high tumor markers but had to wait three weeks for the next available surgery date at a government hospital. After the family sought a second opinion from a private hospital, the advice was to have the operation done as soon as possible. Eventually, cyberbatt’s father received surgery at the private hospital, albeit at a substantive cost as he had never made provisions to get private hospital insurance coverage. On hindsight, cyberbatt feels that “the safest choice is still to get covered by private insurers”.

We would too… and here are three reasons why.

1. Longer Coverage, Even Through Recovery

Major illnesses such as cancer, stroke or heart attack may require a long road to recovery and medical expenses continue to be incurred even after a patient is discharged from the hospital. Since MediShield Life does not cover pre-hospitalisation or post-hospitalisation treatment, it is important to ensure that you are fully protected with pre- and post-hospitalisation coverage that only an IP can offer.

AXA Shield is an IP that offers one of the longest post-hospitalisation coverage of 365 days in the market. Its pre-hospitalisation coverage is for up to 180 days prior admission. Like MediShield Life, both AXA Shield Plans A and B are payable by Medisave.

2. High Annual Coverage Limits

Any person who takes up a health insurance policy naturally would hope to fork out as little cash as possible for claimable medical bills, i.e. let the policy pay for the medical bills. However, how much you can claim a year – the annual coverage limit – varies from one IP to another. Moreover, don’t forget that the amount of premium you pay can also determine the amount you can claim up to each year.

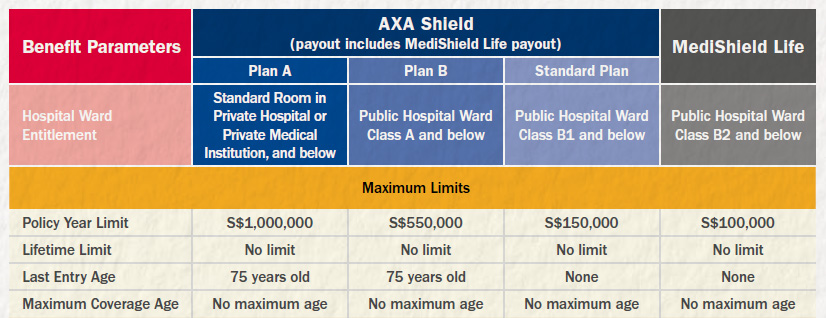

With MediShield Life, the annual coverage is capped at $100,000 per year for public hospital ward Class B2 and below. If you’re opting for a single-bedded ward in a public hospital or for a private hospital stay, consider AXA Shield, which offer high annual coverage limit up to an unprecedented $1 million.

3. More Options, Better Coverage at a Small Additional Price

The good thing about having an IP is that you will automatically be covered by MediShield Life, which will be a component of your IP. There is no duplicate coverage and there is no double premium payment.

Currently, for a person age 41 to 45, the MediShield Life premium is $435 per annum. For an additional $461 per annum, he/she can enjoy the additional benefits of an AXA Shield Plan A private insurance coverage. The total premium of $896 for the IP can be fully paid by MediSave. Some cash outlay is only required for those age 51 and above for an IP.

Finally, depending on your coverage needs and budget, you can choose from AXA Shield’s three different plans – Plan A, Plan B and Standard Plan. In addition, a suite of optional riders will offer you more comprehensive coverage and peace of mind, such as post-hospitalisation home nursing services, post-hospitalisation Traditional Chinese Medicine (TCM) treatment or other requirements.

- For more information on AXA Shield, visit https://shield.axa.com.sg/

- For more details on MediShield Life, please refer to https://www.moh.gov.sg/content/moh_web/medishield-life.html