Protecting our Homes – When Home Insurance is More Than Protecting Against Fires

Submitted by Advertiser KiasuParent

Photo by Daniel Tausis on Unsplash

We heard of how fires in homes were started by Personal Mobility Devices (PMD) being charged. The number of fires arising from PMDs almost doubled last year, to an average of 2 per week!

Even if we do not own a PMD, there remains a potential risk that a fire in our neighbour’s unit could affect ours, resulting in either damage or loss of use of the unit for a period of time. It might be possible to seek restitution from the owner whose unit caught fire, but the process of determining liability would cause great stress to many families. Worse is if our own unit catches fire due to whatever reason and causes damage to our neighbours’ units.

Home insurance has always been a basic insurance most of us would get, given the low premiums and the not improbable chance of catastrophic loss. Many homeowners, especially those staying in HDB flats or had taken loans to purchase their private properties, already do have some basic home insurance compulsorily purchased on their behalf. However, such insurance typically only covers damage to the physical structure of the flat – it doesn’t allow you to recover any cost attributed to your renovation work and home furnishings. That means homeowners need to fork out an additional sum to restore their homes. So what should homeowners look for in deciding what type of home insurance you should be getting?

Here are 3 tips to get started:

-

Does it provide Comprehensive “All-Risk” Coverage or “Named Perils” Coverage?

Under a named perils policy, the burden of proof is on the insured. By contrast, an all-risks policy covers the insured from all perils, except those specifically excluded from the list. Contrary to a named perils contract, an all-risks policy does not name the risks covered, but instead, names the risks not covered.

-

Does it provide “New for Old” Cover for Contents?

It means that you will get a nice new aircon rather than just the amount of money that the old one was worth.

To give an example, Mr A had his heater installed above the masterbath ceiling on the second floor. A leak damaged a large part of the ceiling, the masterbath timber vanity cabinet as well as the marble stone vanity top. Thankfully, when he submitted his claim, he was able to be reimbursed totally for the whole cost of reinstating the whole ceiling and getting the cabinet replaced by a new one, rather than the actual value of the items (which would be near zero as they were pretty old already).

-

Are you providing adequate coverage?

Under most home insurances, the “Average Clause” will result in an underpayment in the event that you have not fully insured the risks. For example, suppose a fire destroys $100,000 out of the $200,000 worth for all the contents in the house valued, but your contents coverage is only $50,000, you can only claim 50% of the $50,000 ($25,000) and not the full $50,000 as you have underinsured the risk.

Home insurance might appear to be a straight forward insurance for most families but the intricacies of the policy might be worth your while to seek clarity from your financial consultant to ensure that you are properly covered for what you need, when the need arises.

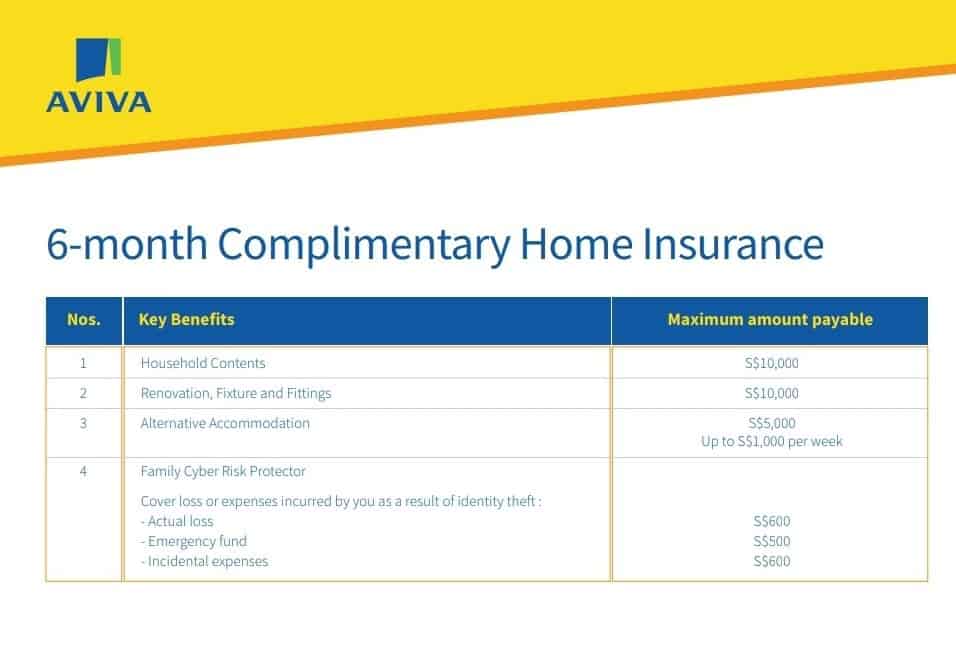

Please submit your details here if you will like a complimentary review of your existing policy and coverage and/or if you will like a free 6-month home insurance from Aviva – see below. (both courtesy of Apex Private Wealth Management Pte Ltd)